22 Feb 2 10 Net 30 Understand How Trade Credits Work in Business

Content

However, purchases are crucial to the operations of these companies. Usually, companies acquire goods for credit and pay for them at a later date. During this process, they may also receive a purchase discount. If the payment is made within the discount period, Accounts Payable should be debited, and Cash should be credited for the amount at which the payable was originally recorded. It is shown as an expense in the Profit and loss account. Then, the receivables are reduced with the amount of discount allowed.

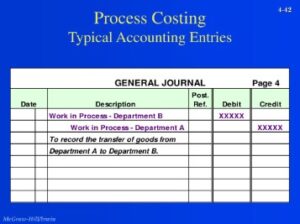

The following video covers how to journalize purchases under the periodic inventory system. We will look at this transaction under both methods so you can see the difference. Before we start looking at each method, let’s start by discussing what is the same under each of the methods. The first transaction deals with the purchase of the inventory. The second transaction deals with the payment for the instruments already received. You might prefer to record your purchases as the invoice amount, less the discount which, as Accounting Coach explains, yields the net purchase amount.

What are some benefits of using net method of recording purchase discounts?

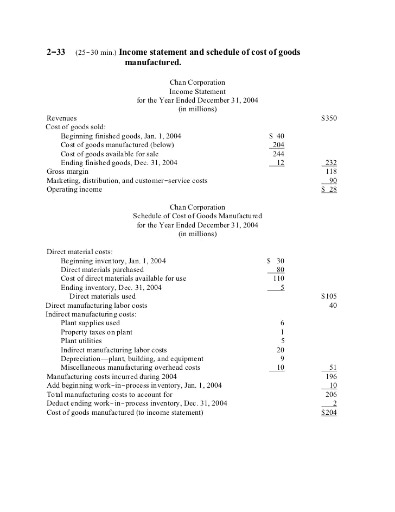

Then, the payable is reduced with the amount of discount received. Compute the company’s total cost of merchandise purchased for the year. Sales discount is reported by the supplier as an expense because it reduces the benefits generated from the sales. However, the need for frequent physical counts of inventory can suspend business operations each time this is done. There are more chances for shrinkage, damaged, or obsolete merchandise because inventory is not constantly monitored.

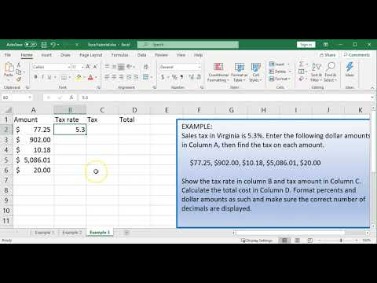

This means that the company can deduct $280 (1% of $28,000) if it pays the invoice within 10 days. Otherwise, the company must pay $28,000 within 30 days. The early payment discount is also referred to as a purchase discount or cash discount. The net method works by recording any purchase discounts obtained from suppliers as an immediate offset to the cost of goods purchased.

Business Operations

In other words, it is encourage to buyer for buying with cash rather than buying on credit. Discount allowed is the loss of business but there is big strategy of long term gain. If any customer will pay us in cash at this time or before the time when he will actually pay for his goods bought goods on credit, then, we will allow discount. Secondly, it will help to increase working capital for day to day expenses. So, many organisations have clear policy to allow discount. DateAccountDebitCreditMay 6Accounts Payable350Purchase returns and allowances350To record return of merchandise for credit.The entry would have been the same to record a $ 350 allowance.

How do you record purchases with a trade discount?

Accounting of trade discount

Sales are recorded based on net price. Net price = List price – Trade discount. Therefore, trade discounts are not recorded in the books of accounts. However, on the other hand, cash discounts are recorded in the books of accounts.

There are two ways in which a company may account for their inventory. They can use a perpetual or periodic inventory system. Let’s look at the characteristics of these two systems.

Net Method of Recording Purchase Discounts FAQs

Calculate the trade discount and the net price Carl&Co pays if the desk’s list price is $150. Is a term used when inventory or other assets disappear without an identifiable reason, such as theft. For a perpetual inventory system, the adjusting entry to show this difference follows. This example assumes that the merchandise inventory https://kelleysbookkeeping.com/ is overstated in the accounting records and needs to be adjusted downward to reflect the actual value on hand. Here, we’ll briefly discuss these additional closing entries and adjustments as they relate to the perpetual inventory system. Using the purchase transaction from May 4 and no returns, Hanlon pays the amount owed on May 10.

If we take a discount for paying early, we record this discount in the purchase discount account under the periodic inventory method. In our example for Hanlon, May 4 was FOB Destination and we will not have to do anything for shipping. On May 21, shipping terms were FOB Shipping Point meaning we, as the buyer, must pay for shipping. Under the periodic inventory system, we will debit Transportation In for the shipping cost and credit cash or accounts payable depending on if we paid it now or later. The net method of recording purchase discounts records the purchase and the accounts payable net of the allowable discount. Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount.

Accounting for Early Pay Discounts: Gross Method

Under this method, you would record any lost discounts in a separate account. This purchase discount of $60 will be offset with the purchase account and be cleared to zero at the end of the accounting period. The net amount is not mentioned earlier on in the analysis because it is still not confirmed if the company will be able to pay the dues in time to be able to avail of the cash discount. The incentive to the buyer of purchase discount is that the purchase costs decrease, and the business can save a considerable amount on procurement costs. Accounts payable are recorded at their expected cash payment at the time of purchase.

How do you record purchase discounts?

The net method of recording purchase discounts records the purchase and the accounts payable net of the allowable discount. If the payment is made within the discount period, Accounts Payable should be debited, and Cash should be credited for the amount at which the payable was originally recorded.

Trade discounts are not recorded in the books of accounts. Instead, it is generally given at sales, like on bulk purchases. Hence, the Purchase Purchase Discount Journal Entry amount is shown as a net trade discount in the books. The biggest risk to a supplier when offering trade credit is the potential for bad debt.

No Comments